If you haven't discovered the joys of A2X yet…well, today might as well be Christmas for you.

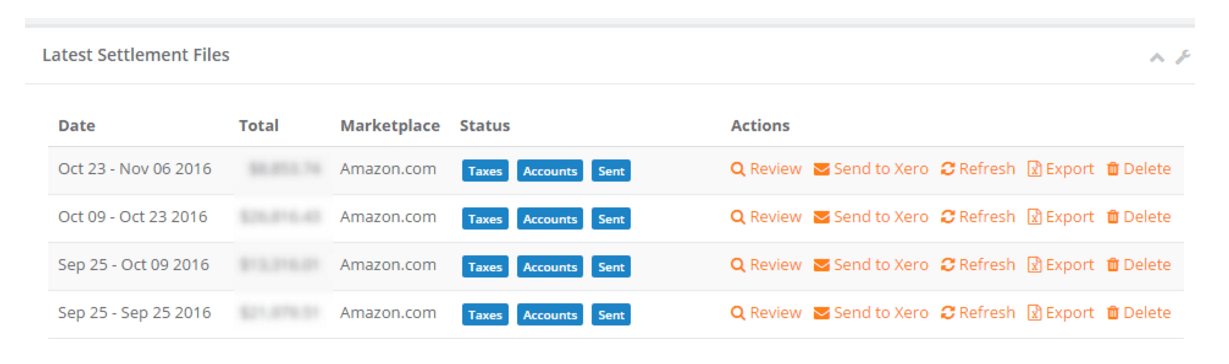

This nifty online tool integrates your Amazon financial data into your Xero chart of accounts. Just like magic. No more individual transaction entries. No more untangling the mess of seller fees. Just your two biggest sources of financial data, playing nice together in a little sandbox called A2X.

Think it's too good to be true? Don't take our word for it. Our pals over at Catching Clouds wrote all about their experience using this amazing tool.

Check it out…and when you're done, mosey over to the A2X blog for another post that walks you through the process of setting up your Amazon and Xero accounts to play together.

When deciding which tool to start with in our Useful Tools Series, there was no doubt in my mind we should start with A2X (this name presumably comes from “Amazon to Xero”), This is a MANDATORY tool for anyone selling on Amazon Seller Central. Did you hear me? Mandatory. It will rock your world, I kid you not.

Let’s start with a little history.

A Little History

When Catching Clouds got its first Amazon seller client back in early 2012, we started to dig into the data.

Like most good accountants, we would see a deposit hit the checking account, so we would try to get details on the transaction by logging into the Amazon Seller Central account. We found that Amazon was “super helpful” and gave us nifty reports that matched the amounts landing in the bank account.

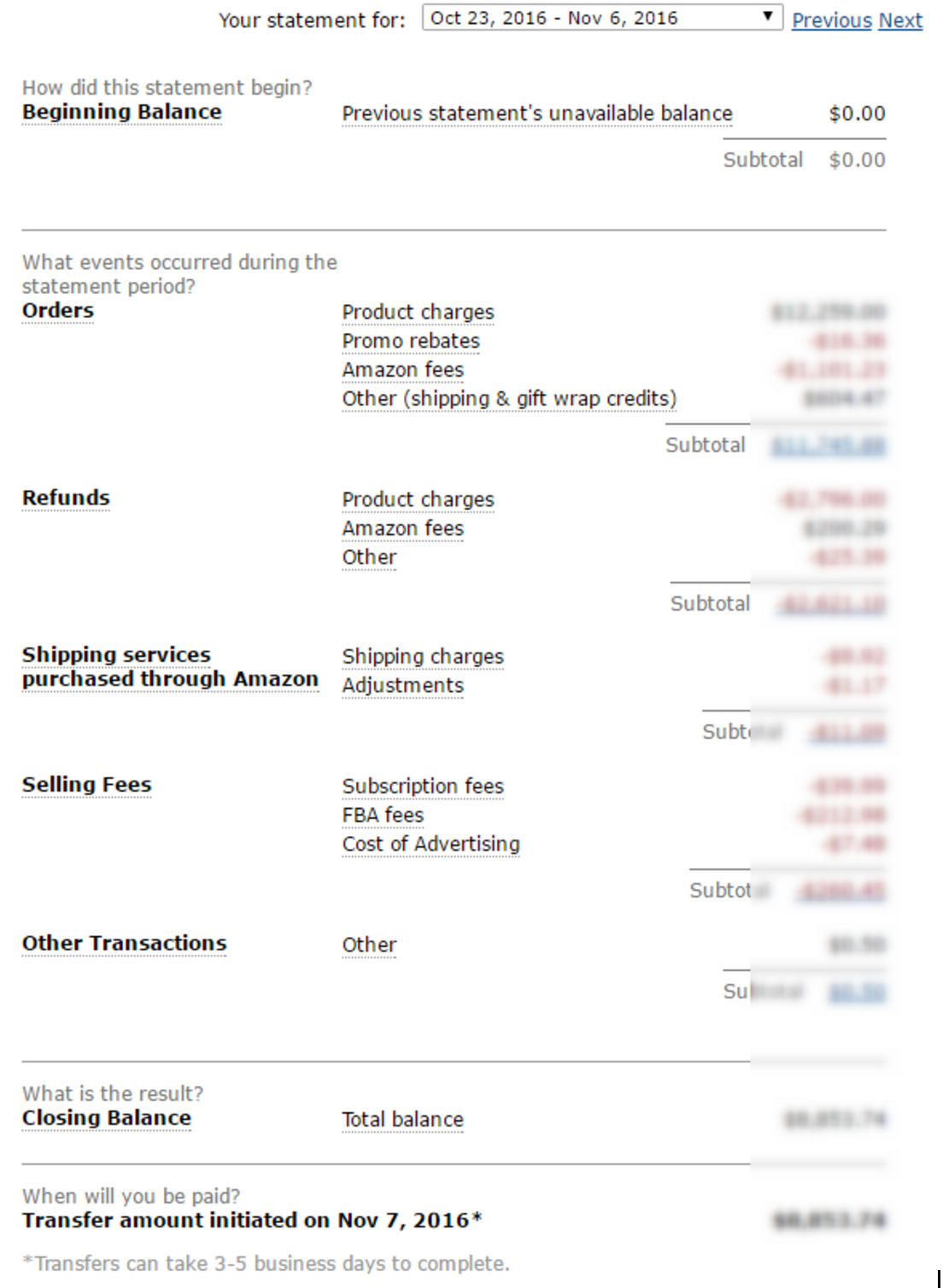

That Amazon report looks something like this:

That’s fabulous, right?

But soon thereafter, we noticed a couple of problems.

Welcome to the Nightmare

1) SALES TAX.

Umm… the seller was collecting sales tax, but that amount wasn’t broken out anywhere on this report.

Sales tax is *not* income. It’s money that is collected on behalf of the government and at no point belongs to the seller. It’s a liability and needs to be paid to the city, county and/or state, so knowing how much is owed is a pretty big deal. In fact, if you collect it and don’t remit it, it’s literally a crime.

Darn. We really need that number. We don’t really like it when our clients go to jail.

2) CUTOFF DATE.

If you look at the above example, you’ll see that the dates span both October and November. In accrual basis accounting, you need to report the October sales in October and the November sales in November. But this report doesn’t give you a breakdown of which sales fall in which period.

We always try to keep the end reports in mind when building the accounting processes, and if there’s no way to know which sales fall in which period, the sales can’t be recorded accurately in the right periods each month. Some months may be too high and others too low.

In short, the seller will have financial reports that are horribly difficult to analyze from month to month.

So… drat. That’s not as helpful as we thought.

So then we just moved a few tabs over and started looking at the raw order data.

We found a couple of new, fun surprises awaiting us there.

1) I beg of you, please don’t try importing transaction by transaction.

Just because you *can* import individual sales data doesn’t mean you *should*. We tried using a web connector tool that would automatically pull the raw data from Amazon and feed it into Xero.

We quickly learned that even data for a relatively small Amazon seller will crush any cloud accounting general ledger. And it’s impossible to reconcile it to what got deposited into the bank anyway.

Just say no. You don’t need all that detailed crap in there. You already have it in Amazon if you ever need it.

2) Summarizing everything is at least getting you on the right track.

Now the problem is that Amazon has about 18 gazillion fees, give or take, and they add new funky fees constantly.

The fees are also all super-intuitive like “Other Other Transaction Other Transaction RemovalComplete” not to be confused with “Other Other Transaction Other Transaction Buyer Recharge” or “Other Other transaction Other Transaction Balance Adjustment.” Huh?

We did our best to group and summarize the data to more efficiently record the transactions in Xero, but…

3) Even if you could get good summaries of all the data, it’s virtually impossible to then match it up to what gets deposited into the bank account.

Dealing with all of this was a nightmare and sucked up way too much of our time, patience, and brain cells.

Birds Sang and Angels Wept

But then we found A2X, and here is why we are in love with them.

1) Set up is quick and easy.

2) Data beautifully exports to Xero.

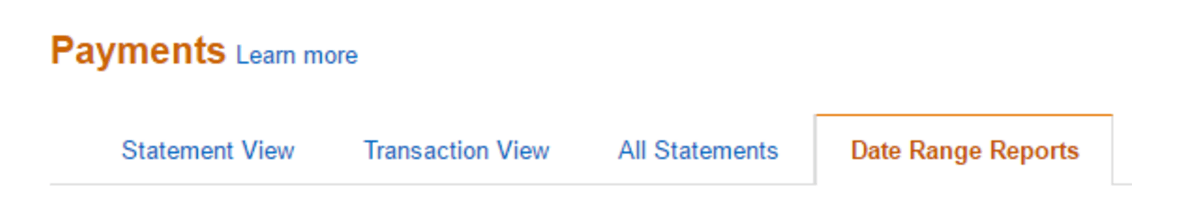

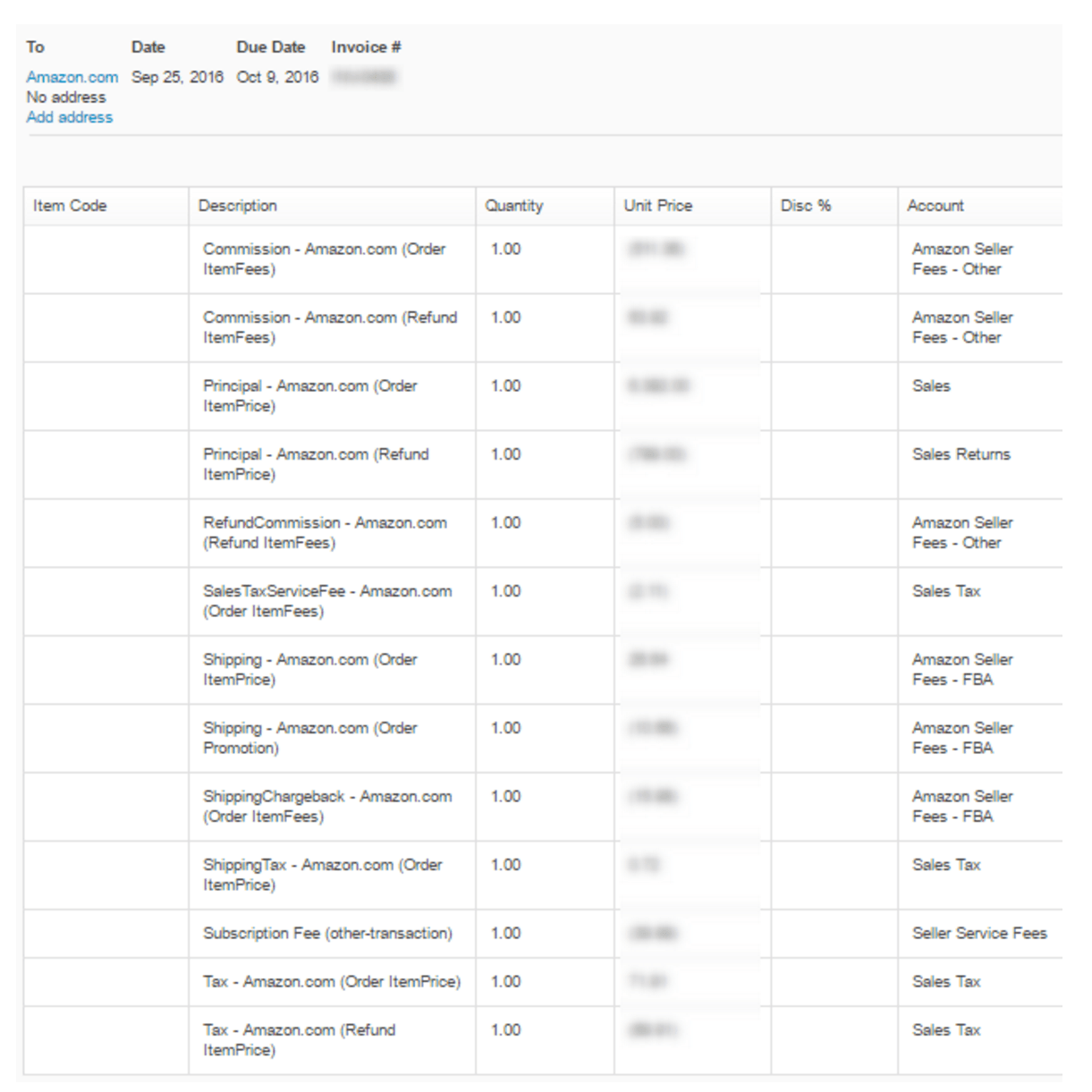

Basically, when Amazon batches out, A2X knows about it and pulls all the details and summarizes each batch into one or two sales invoices (two invoices if the batch spans two months… the first invoice will be through the end of the month, and the second invoice will be for the remaining days in the subsequent month).

Those invoices can either be manually “pushed” to Xero with a click of the “Send to Xero” button… or… you can set it up to automatically push invoices as draft invoices in Xero when they are available from Amazon.

[Tweet “Amazon seller fees got your head spinning? There's a @xero tool for that. Introducing #A2X.”]3) Customizable coding.

Some people want to track every fee separately, and others want the bulk of the fees all lumped together. Regardless, A2X allows you the ability to customize the coding for the invoices so they come into Xero based on the customized mapping.

4) Sales tax collected shows up on the invoices.

Yeah! You’re tracking sales tax liability which means you know how much to send to the government so they don’t haul you away in handcuffs. Be aware, however, that sales tax is all combined at this level. There is another report available from Seller Central to help break out sales tax.

5) The bank deposits always match up to the invoice(s) created.

There’s no mystery in how to reconcile to the bank deposits. You reconcile them directly against the one or two invoice(s) that were created for the batch. It feels like magic.

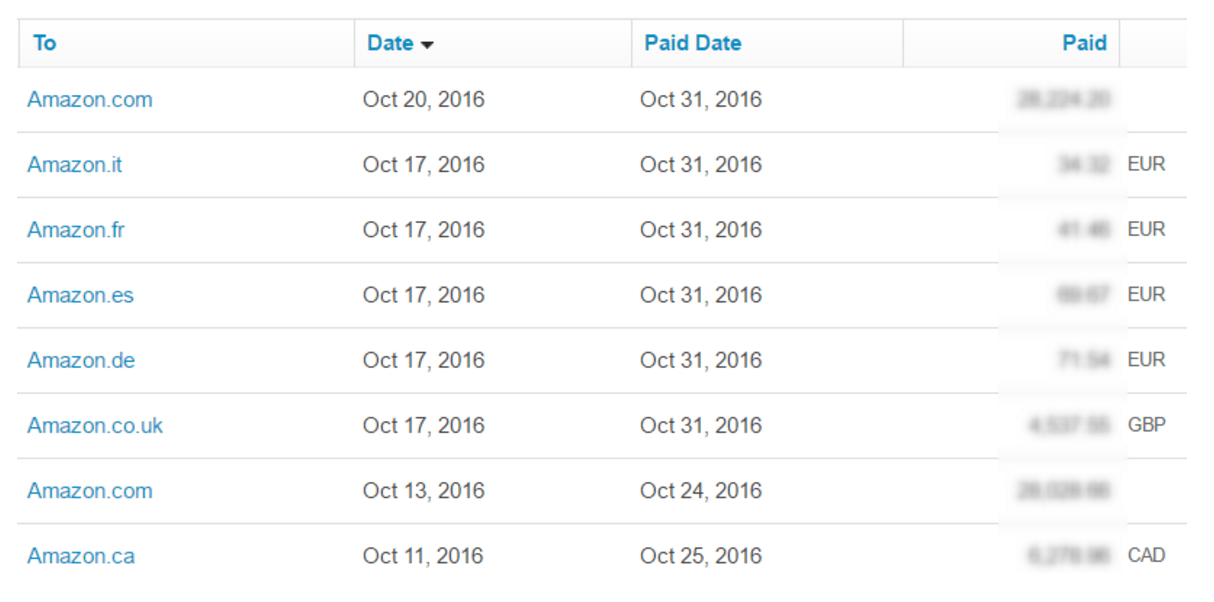

6) Works with foreign Amazon seller accounts too!

A2X also works for people selling on foreign Amazon platforms. Invoices are created in foreign currencies (because Xero is awesome at handling foreign currency transactions), and it works exactly the same way.

In Short….

Compared to the heavy lifting we used to do (unsuccessfully, at that), A2X is a dream come true. It is far and away one of our favorite tools for accuracy, reliability, ease of use, and overall value.

If you couldn’t tell, we love this tool and happily use it for every single one of our clients who sells on Amazon Seller Central.